Top Casino Gaming Companies

- Top Casino Gaming Companies

- Top Casino Gaming Companies Near Me

- Largest Casino Gaming Companies In The Us

- Top 10 Casino Gaming Companies

There are several large casino and gaming companies that own the majority of casinos around the U.S. For instance, there are MGM Resorts and Caesars Entertainment Corporation casinos in several different cities. Some of these major gaming corporations even work with tribes to develop casino operations on tribal lands. The newer players – mostly companies outside the US – are players in the mobile gaming divisions. The entire industry made over $40 billion in revenue in 2018 according to Forbes Online. The top five game companies made most of that profit. The smaller companies struggle, and even some top publishers are laying off employees. Top slot gaming companies in 2020 There is a variety of gaming content manufacturers, so finding games for an online casino is not usually a problem. However, when choosing a game provider, pay attention to the company’s reputation, quality and mathematics of games, language support, gameplay possibilities, the position of games in various. The Casino and Gaming Market report considers the major factors accountable for driving the growth of the Casino and Gaming Industry, in addition to the key hindrances and challenges. Moreover, the Casino and Gaming Market report analyzes the industry from a 360-degree perspective. Casino Gaming Software Companies. Casino software plays a bigger part in online casinos and the player’s experience than what you may think. That is why we are here to analyse the best online casino software of 2020.

The video gaming industry is one of the most competitive businesses in the world. Heavy-hitters like Sony and Microsoft are backed by decades of profit making in other electronics and computers. Other companies are on the list on the strength of strong sales for historically popular games. The newer players – mostly companies outside the US – are players in the mobile gaming divisions.

The entire industry made over $40 billion in revenue in 2018 according to Forbes Online. The top five game companies made most of that profit. The smaller companies struggle, and even some top publishers are laying off employees. There may be some changes in the bottom five on this list year to year, but the top five are probably there to stay.

Gung Ho Online

2018 Revenue: $1.6 billion

Best-selling game: Puzzles and Dragons

Founded: 1998

Source: Gung Ho Entertainment

This company has built its fortune in the online gaming market. It started business as a developer of an online auction site as a subsidiary of Japanese cell phone company Softbank. In 2000, the company switched to online gaming services, hosting servers in Japan for a MMOG. In 2013, it released an in-house developed mobile game, Puzzles & Dragons, which accounts for the majority of its revenue. It has also acquired other game publishers since it purchased back shares from Softbank.

Did You Know?

Puzzles & Dragons is the second-highest earning mobile game ever.

Ubisoft

2018 Revenue: $1.9 billion USD

Best-selling game: Assassins’ Creed

Founded: 1986

Source: Gage Skidmore [CC BY SA 2.0] via Flickr

Ubi Soft was originally a family-owned, mail order hardware and software business run from the suburbs of Paris. It was a family business whose members soon recognized the growing interest in PC games. Ubi Soft developed some titles in-house that were successful in Europe but did not translate well overseas. Eventually, the company purchased rights to distribute other titles, which enabled them to buy Red Storm Games, the maker of a popular game based on the Tom Clancy novels.

Aside from the Assassin’s Creed series, Ubisoft is known for the Far Cry series and Just Dance.

Did You Know?

Electronic Arts bought, and later sold, shares in Ubisoft.

King

2018 Revenue: $1.9 billion

Best-selling game: Candy Crush saga

Founded: 2003

Source: Iswjy1mcb [CC By SA 4.0] via Wikimedia Commons

King initially developed games that users could play within their web browser, eliminating the need to download and/or install software. That model didn’t prove successful initially. However, the company found success producing games for use on social media platforms like Facebook.

Within social media gaming, King would make money via so-called “micro-transactions” and through in-game advertising. This caused revenue growth of over $1 billion within two years.

Did You Know?

One of the co-founders of King sold his ownership stake years before the company became one of the top earners.

Namco Bandai

2018 Revenue: $2.20 billion

Best-selling game: Tekken series

Founded: 2005

Source: Bandai Namco [Public Domain] via Wikimedia Commons

Namco was already a well-known arcade game company. Bandai, a toy maker and TV show producer, has some of the world’s best-known brands, like Power Rangers. In 2005, the gaming divisions of the two companies merged.

The merged Namco Bandai Studios has some of the longest running and most popular console fighting games, such as Tekken and Soul Caliber. It also has released a number of games based on Bandai-owned IP like Dragonball and Gundam.

Did You Know?

The Bandai Namco manufacturing division is the largest toy company in the world based on revenue.

Electronic Arts

2018 Revenue: $3.49 billion

Best-selling game: FIFA 18

Founded: 1982

Source: King of Hearts [CC BY SA 3.0] via Wikipedia

Electronic Arts may be one of the most widely recognized brands in gaming culture. Former Apple employee Trip Hawkins started the company with financing and began producing a variety of games for the growing home computer market. It was a few years after the company began that EA began working on a pro football simulator that would spawn one of its more popular games, Madden NFL.

EA’s sports games are what made the company a success. However, EA acquired a number of studios over time, producing or co-producing popular games from other subgenres.

Did You Know?

Former UCLA basketball star Ed O’Bannon sued EA for using his likeness without permission. EA settled with O’Bannon, but stopped making college sports games because of the suit.

Activision Blizzard

2018 Revenue: $3.5 billion

Best-selling game: Overwatch, WoW

Founded: 2008

Source: Activision Blizzard [Public Domain] via Wikimedia Commons

Activision and Blizzard were separately to of the most successful game publishers and developers of the 1990s, with Activision being one of the oldest companies in the business. During a downturn in the home gaming industry, Activision was purchased by a tech CEO and regained market share.

Blizzard was a pioneer in the online, multiplayer strategy games like Warcraft. The French company Vivendi purchased Blizzard, and Activision later acquired Vivendi’s gaming division, which included Blizzard.

Did You Know?

Activision was responsible for many of the earliest popular console games, including Pitfall first sold for the Atari 2600 in 1982.

Nintendo Company

2018 Revenue: $4.2 billion

Best-selling game: the Mario series

Founded: 1886

Source: Evan-Amos [Public Domain] via Wikimedia Commons

Nintendo was in the gaming business long before computers were invented, making playing cards, and later on, toys and arcade games. It entered the console game industry in the 1970s when it distributed the Odyssey console in Japan. In 1981, it developed and released Donkey Kong, the game that spawned the signature character Mario.

Nintendo is perhaps better known for the consoles and gaming devices it has created rather than its games. The company produced a console in 1977 before launching the Famicom, NES and Game Boy systems later.

Did You Know?

The French Culture Minister knighted Shigeru Miyamoto, the creator of Donkey Kong, in 2006.

Microsoft (Xbox Games)

2018 Revenue: $7.79 billion

Best-selling game: Halo, Minecraft

Founded: 2002

Source: Pexels [CC0]

Bill Gates’ company had always had an in-house game division that produced and published games with the MS-DOS operating system and for Windows. The company created a separate division for games in 2000 when it entered the console gaming arena and announced the Xbox.

Xbox Games develops and publishes games for the PC and for the console as well as publishing mobile and web browser games. It has also acquired Mojang, the developer and publisher of Minecraft.

Did You Know?

The Microsoft game Minesweeper has been included with every version of Windows (in some form) since 1992.

Tencent Games

2018 Revenue: $8.3 billion

Best-selling game: Arena of Valor

Founded: 2003

Source: Public Domain

Tencent Games is a division of Tencent Holdings, a Chinese holding company with a variety of business interests, including online gaming. From the beginning, the gaming company focused on online and social media gaming to meet the interests of the growing Chinese mobile communications market. Its parent company has invested in a variety of game publishers and hosts.

Today the company continues to focus on online and mobile gaming and has its own streaming platform. It’s the largest valued game company.

Did You Know?

Tencent’s purchase of 40% of the company that makes Fortnite may make the company the largest in the world by revenue soon.

Sony Computer Entertainment (SCE)

2018 Revenue: $10.5 billion

Best-selling game: The Last of US, Gran Turismo

Founded: 2003

Source: Solomon 203 [CC BY SA 4.0] via Wikimedia Commons

A division of electronics and entertainment conglomerate Sony, SCE began in 1993 when Sony announced the production of the Playstation game console. Since then, SCE has become the largest video game company in the world based on annual revenue.

SCE oversees the production of the hardware and peripherals for Playstation games. It is also the parent company of Sony Interactive Entertainment Worldwide (SIE), the company that oversees the production of Sony games. Many of the studios under SIE were acquired by takeover.

Did You Know?

Sony’s revenue comes from its hardware, as it only placed two games (Marvel’s Spider Man and God of War) in the top ten list in 2018.

Updated on September 14th, 2020 by Bob Ciura

As the saying goes, the house always wins. Casinos operate strong business models, as casinos earn a virtually guaranteed profit from the sum of the bets they receive. The relatively attractive economics of casinos make the industry worthy of a closer look.

Investors may be particularly intrigued by the earnings growth and dividends of the major casino stocks. The 4 major publicly-traded casino stocks all pay dividends to shareholders, but they are far from the safest dividend stocks around.

If you are looking for a safer basket of dividend growth stocks, consider the Dividend Aristocrats. They are an elite group of 65 stocks in the S&P 500 Index with 25+ years of rising dividends.

You can download an Excel spreadsheet of all 65 Dividend Aristocrats (with important financial metrics such as dividend yields, P/E ratios, and dividend payout ratios) by clicking the link below:

Click here to download your Dividend Aristocrats Excel Spreadsheet List now.

Casinos are not without a fair amount of risk. Casinos are highly vulnerable to recessions, as consumers typically cut back heavily on gaming when the economy enters a downturn. The four major casino stocks saw their earnings collapse during the Great Recession. A similar impact has taken place to start 2020 due to the coronavirus crisis, which has battered the casino industry.

We have analyzed the major casino stocks in the Sure Analysis Research Database, which ranks stocks based upon the combination of their dividend yield, earnings-per-share growth potential and valuation to compute expected total returns. In this article, we will compare the expected 5-year total annual returns of the four major casino stocks.

Table Of Contents

For this article, stocks are ranked in order of least attractive to most attractive. While 5-year expected returns are incorporated in the rankings, we have also utilized a qualitative screen based on balance sheet strength and overall business quality.

You can instantly jump to a particular section of the article using the links below:

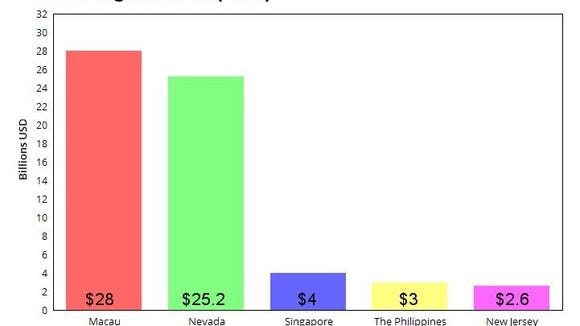

Casino Industry Overview

The casino industry is in severe distress right now. The spreading coronavirus and resulting global recession have taken their toll on the casino stocks. The large U.S. casinos are heavily reliant on Macau, the largest gaming market in the world and the only market in China where casinos are legal. As a result, these stocks are very sensitive to any developments that affect the gaming activity in Macau.

This was a significant concern several years ago. In 2014, China initiated an anti-corruption regulatory crackdown, which greatly reduced the gaming activity in the area. Fortunately for the casinos, the downturn lasted for approximately two years and gaming activity in Macau recovered thereafter. Then the gaming activity in Macau faced another headwind, namely the trade war between the U.S. and China.

This headwind lasted for only about a year but now Macau is facing its strongest challenge ever, the outbreak of coronavirus, which has caused a huge hit in the gaming business. Casinos were shut down for an extended period due to the coronavirus. Visa restrictions have also added to the decline in gaming activity in Macau.

As a result, gross gaming revenue in Macau plunged 94.5% in August, compared with the same month last year. Gross gaming revenue in Macau declined 81.6% through the first eight months of 2020. The high sensitivity of casino stocks to all the developments related to China and their pronounced cyclicality means that investors should pick casino stocks carefully.

Top Casino Stock #4: Wynn Resorts (WYNN)

Wynn Resorts owns and operates Wynn Macau and the Wynn Palace in Macau, as well as Wynn Las Vegas and Encore in Las Vegas. Since Wynn Resorts is highly leveraged to the gaming activity in Macau, it saw its earnings collapse and it cut its dividend by 62% in 2015-2016 due to the Macau downturn that was caused by the anti-corruption regulatory crackdown in the area. But as Macau strongly recovered in the last three years, Wynn Resorts returned to growth.

Unfortunately, the company is now facing the headwind of coronavirus in all the regions in which it operates. Wynn Resorts reported earnings results for the second quarter on 8/4/2020. Revenue declined 95% year-over-year to $85.7 million, which was $190 million less than expected. The company lost $6.14 per share in the quarter, missing estimates by $1.23. Adjusted property EBITDA was a loss of $322.9 million compared to estimates of a loss of $314 million. This compared unfavorably to adjusted EBITDA of $480.6 million in the second quarter of 2019.

Results for Wynn Resorts were once again severely impacted by the COVID-19 pandemic as properties in Macau were closed for 15 days. Las Vegas operations didn’t open until June 4th.Wynn Palace revenues declined 98.6% as a result. Revenues for Wynn Macau decreased 97.8% while Las Vegas decreased 86% year-over-year. Wynn Resorts suspended its dividend in an effort to conserve capital. Consensus estimates call for a loss of $11.52 per share for 2020.

On the bright side, casinos are gradually reopening, and Wynn Resorts seems to have ample room to grow in the upcoming years thanks to its promising growth pipeline.

Source: Investor Presentation

The company has made progress in the design of Crystal Pavilion in Macau, which will be a major tourist attraction. In addition, Encore Boston Harbor opened in June-2019 and has exhibited strong performance so far so it has promising growth prospects ahead thanks to expected ramp-up in activity.

Moreover, the company has been caught off guard, with total current and long-term debt outstanding of $12.78 billion and cash and cash equivalents of $3.80 billion. Therefore, the stock is carrying an increased amount of risk right now due to its high level of debt.

However, we believe that the coronavirus crisis will not last beyond this year and we view the long-term growth prospects of the company as intact. We expect 4% annual EPS growth through 2025. Using the company’s current assets, return on assets of 5.6% over the last decade and share count, we believe Wynn Resorts has earnings power of $1.89. We will use this figure to calculate fair value and projected return.

Based off of the earnings power estimate for 2020, the stock is currently trading at a P/E ratio of 44, which is higher than its historical average of 30.1. However, the stock traded at abnormally high P/E ratios in some years due to depressed earnings in those years.

For instance, the abnormally rich valuation of the stock during 2015-2017 resulted from the market’s view that the downturn in Macau was temporary. Our target P/E ratio of 18 reflects uncertainty regarding Macau and the coronavirus. If shares reverted to our target P/E by 2025, then valuation would be a 16% headwind to annual returns over this time period.

If the stock reaches our fair valuation level over the next five years, it would reduce shareholder returns by 16%, effectively wiping out earnings growth and dividends over that time period. The stock is markedly volatile due to its high debt load, which is an added risk factor.

As a result, only those who can stomach extreme stock price volatility and have confidence in the ability of Wynn Resorts to navigate through the current crisis should consider buying the stock.

Top Casino Stock #3: MGM Resorts (MGM)

MGM Resorts owns and operates casinos, hotels and conference halls in the U.S. and China. The company has the least exposure to Macau in this group of stocks. As a result, it suffered much less than its peers from the trade war between the U.S. and China and the protests of people in Macau a few months ago.

However, the company is highly exposed to the outbreak of coronavirus, just like its peers. Due to the rapid spread of the coronavirus, MGM Resorts suspended all its casino operations in Las Vegas on March 16th and did not accept hotel reservations for the dates prior to May 1st. The company also closed its casino in Maryland.

In late July, MGM Resorts reported (7/30/20) financial results for the second quarter of fiscal 2020. The company began reopening its U.S.properties in the quarter but its revenue plunged -91% over last year’s quarter due to the suspension of the operations of the company in the U.S. and a collapse in gaming revenues in Macau caused by travel restrictions and social distancing.

Source: Investor Presentation

As a result, MGM Resorts switched from a profit of $0.23 per share in last year’s quarter to an adjusted loss of -$1.52 per share.

Due to the unprecedented downturn that has resulted from the pandemic, MGM Resorts cut its dividend by 98% in April. Moreover, in May, it issued $750 million of 5-year bonds at 6.750%. The high interest rate reflects the desperation of the company for funds and the high debt load of the company. Net debt is $20.0 billion, which is nearly twice the current market cap of the stock.

On the positive side, on August 20th, 2020, IAC (IAC) reported a 12% stake in MGM Resorts for approximately $1 billion. IAC has a portfolio of brands and digital expertise, which is expected to help MGM Resorts leverage its digital assets. IAC will join the Board of Directors of MGM Resorts. The stock jumped 12% on the announcement.

Nevertheless, due to the headwind of coronavirus, along with a huge debt load, shareholders should not expect a material boost in dividends and share repurchases for the foreseeable future. That said, the company has a positive long-term outlook for conventions and sports betting in the domestic market, as well as the ramp-up of the recently-built MGM Cotai resort, MGM Springfield, and Park MGM.

As soon as the coronavirus crisis comes to an end, MGM Resorts will benefit from these growth drivers. The company will also enhance its earnings growth via its initiative “MGM 2020”, which aims to expand margins by reducing operating costs and enhancing the efficiency of the company.

Due to the headwind from coronavirus, we expect MGM Resorts to report a net loss in 2020. Earnings-per-share are expected to gradually turn positive, with expected annual growth of 5% through 2025. After the massive dividend reduction, returns from dividends will be negligible until the full dividend is restored. Finally, a contracting valuation multiple could be an additional headwind for shareholders. Overall, we expect negative total returns in the mid-single-digits over the next five years.

Top Casino Stock #2: Melco Resorts (MLCO)

Melco Resorts owns and operates casino gaming and entertainment casino resort facilities in Asia. As Melco Resorts is the most leveraged to the gaming activity in Macau in this group of stocks, it is the most vulnerable company to the downturn in the area due to the outbreak of coronavirus.

Melco Resorts will greatly benefit as the US slowly returns to a more ‘normal’ level of activity as COVID-19 fears and cases hopefully decline. A COVID-19 vaccine would likely be a major boost for the company.

In 2019, Melco Resorts grew its revenue 11% and its earnings per share 15%, primarily thanks to its strong performance in the mass market table gaming activity. But conditions have predictably reversed, with second-quarter revenue declining 88% and adjusted property EBITDA declining to a loss of $156.3 million.

Source: Investor Presentation

As soon as the effect of coronavirus begins to fade, the company has promising growth prospects ahead. It will benefit from the ramp-up of activity in its Morpheus Resort, which opened in mid-2018, and attract an increasing number of visitors in Cotai thanks to improvements in mass transportation.

Melco Resorts is also expanding its City of Dreams in Macau and is taking steps to open an integrated resort in Yokohama, Japan. All these initiatives are likely to be significant growth drivers as soon as Macau returns to normal.

On the other hand, due to its extreme leverage to gaming activity in Macau, the stock is highly vulnerable to any negative development related to coronavirus. Therefore, despite the promising growth prospects, we hold modest expectations for Melco, due to its extreme leverage to the activity in Macau.

It is worth noting that the gaming activity in the area was facing another headwind, protests from civilians, before the outbreak of coronavirus. Overall, we expect 2% average annual growth in earnings per share over the next five years.

The company is expected to post a significant loss for 2020. Earnings-per-share are expected to recover to $0.11 in 2021 and $1.08 in 2022. In a normalized economic backdrop, this would mean the stock trades for a P/E ratio of approximately 18, based on 2022 earnings. We view the stock as fairly valued.

Therefore, shareholder returns will be fueled by earnings-per-share growth. The stock had a 4%+ yield recently, but the company has suspended its dividend for the foreseeable future in an effort to preserve cash. Therefore, total returns are expected at just ~2% per year until the dividend is restored.

Given its healthy balance sheet, the company is likely to resume paying dividends once the coronavirus crisis ends. On the other hand, income-oriented investors should remain cautious, as the company is highly vulnerable to economic downturns and is very sensitive to any casino-related policy change in China and the ongoing coronavirus crisis.

Top Casino Gaming Companies

Top Casino Stock #1: Las Vegas Sands (LVS)

Las Vegas Sands is a leading developer and operator of integrated resorts in the U.S. and Asia. Due to the outbreak of coronavirus, Las Vegas Sands is facing strong headwinds in Macau and in the U.S. As mentioned above, gaming activity has collapsed in Macau. In addition, due to the propagation of the virus in the U.S., all the casinos in Las Vegas were closed for a considerable period. As a result, Las Vegas Sands will incur a significant hit to its earnings this year.

On the other hand, beyond this year, Las Vegas Sands has promising growth prospects ahead. As Japan legalized casino gambling three years ago, Las Vegas Sands has announced that it intends to open integrated resorts in Tokyo and Yokohama. The company is the favorite bidder in this contest, which is expected to be a significant growth driver, though it will take a few years until the company earns a license and builds its new properties in Japan.

Top Casino Gaming Companies Near Me

Not only do we see potential for strong earnings growth along with a high dividend yield for this stock, Las Vegas Sands also earns the top ranking because of its strong balance sheet and healthy liquidity.

Source: Investor Presentation

Furthermore, Las Vegan Sands continues to pursue growth by expanding and upgrading its Macau properties. The company launched Four Seasons Tower Suites Macao last year and it expects to perform its grand opening this year while it also expects to launch the Londoner Macao within 2020-2021 and expand Marina Bay Sands in Singapore.

In addition, Las Vegas Sands will benefit from the debut of the light rail system connecting Macau to the entire China rail network. This project will significantly increase the traffic to the casinos in Macau. Thanks to all these growth drivers and given the suppressed earnings expected this year, we expect the company to grow its earnings per share by about 4% per year over the next five years.

Las Vegas Sands stock previously offered a hefty dividend of $3.08 per share annualized, but the company suspended its dividend in 2020 amid the coronavirus pandemic. If the company were to reinstate its dividend at the same level, shares would yield nearly 6% at the current stock price.

Largest Casino Gaming Companies In The Us

The company is expected to see earnings dry up in 2020; our estimate of its full earnings power in a normal economy is annual earnings-per-share of $3.20. Based on this, the stock has a price-to-earnings ratio of 16.6, which is lower than our fair value estimate of around 17.0. Therefore, we see Las Vegas Sands stock as the only undervalued casino stock.

We also believe Las Vegas Sands has the strongest balance sheet. This means it is likely that the company will easily navigate through the ongoing coronavirus crisis and will enjoy a strong recovery whenever the headwind disappears from the horizon.

Final Thoughts

Gaming activity in Macau enjoyed a strong recovery from 2017-2019. But the coronavirus pandemic brought the recovery to a halt. Macau is now facing another severe downturn, due to the outbreak. The same is true for the U.S. as well, as the coronavirus crisis has resulted in weak demand. As a result, all the above casino stocks are going through a fierce downturn right now.

Melco Resorts seems the least attractive choice whereas Las Vegas Sands has by far the most attractive risk/reward profile. Wynn Resorts and MGM Resorts offer a lower expected return than Las Vegas Sands. Additionally, we prefer Las Vegan Sands for its stronger balance sheet, which is paramount during severe downturns.

While we expect the coronavirus crisis to end later this year, no one is absolutely sure when this crisis will end. To provide a perspective for the severity of the downturn, all the U.S. casino companies asked Congress for emergency financial help, as several industries have been impacted by coronavirus. Certain gaming regions like Las Vegas are preparing to reopen, which would be a major positive step for the casinos.

That said, casino operators will likely see profits evaporate and report significant losses, at least for one quarter but potentially for 2020. There is also the potential for further dividend cuts or suspensions across the industry, if the crisis continues for the remainder of 2020.

Top 10 Casino Gaming Companies

It is thus critical for investors to make sure that their companies can easily endure a prolonged crisis without being devastated. Therefore, the superior balance sheet of Las Vegas Sands is a crucial parameter and helps explain the fact that the market has punished Las Vegas Sands much less than its peers in the ongoing downturn.